Finance and banking

Driving Transformation and Innovation

In a sector marked by heightened competition, stringent regulations, and evolving customer expectations, the finance and banking sector faces multifaceted challenges.

We empower financial institutions to navigate these complexities, innovate their offerings, and maintain a leading edge in the market.

OUR EXPERTISE

What we can do for you

We can help your financial institution leverage technology to enhance services, streamline operations, and stay ahead in a competitive market.

We develop financial planning and portfolio management tools using AI, offering clients tailored advice and automated optimization.

We create seamless payment systems, providing real-time transparency and efficiency similar to consumer payment experiences.

Development of more integrated and user-friendly financial solutions.

AI-driven systems for compliance and risk management that can swiftly adapt to evolving regulatory landscapes, ensuring businesses stay ahead of compliance requirements.

Accelerate your digital transformation by adopting cloud technologies and modernizing legacy systems. We enhance security measures to protect against cyber threats and ensure regulatory compliance.

We develop tools to manage spend and increase revenue opportunities through usage-based billing models.

OUR WORK

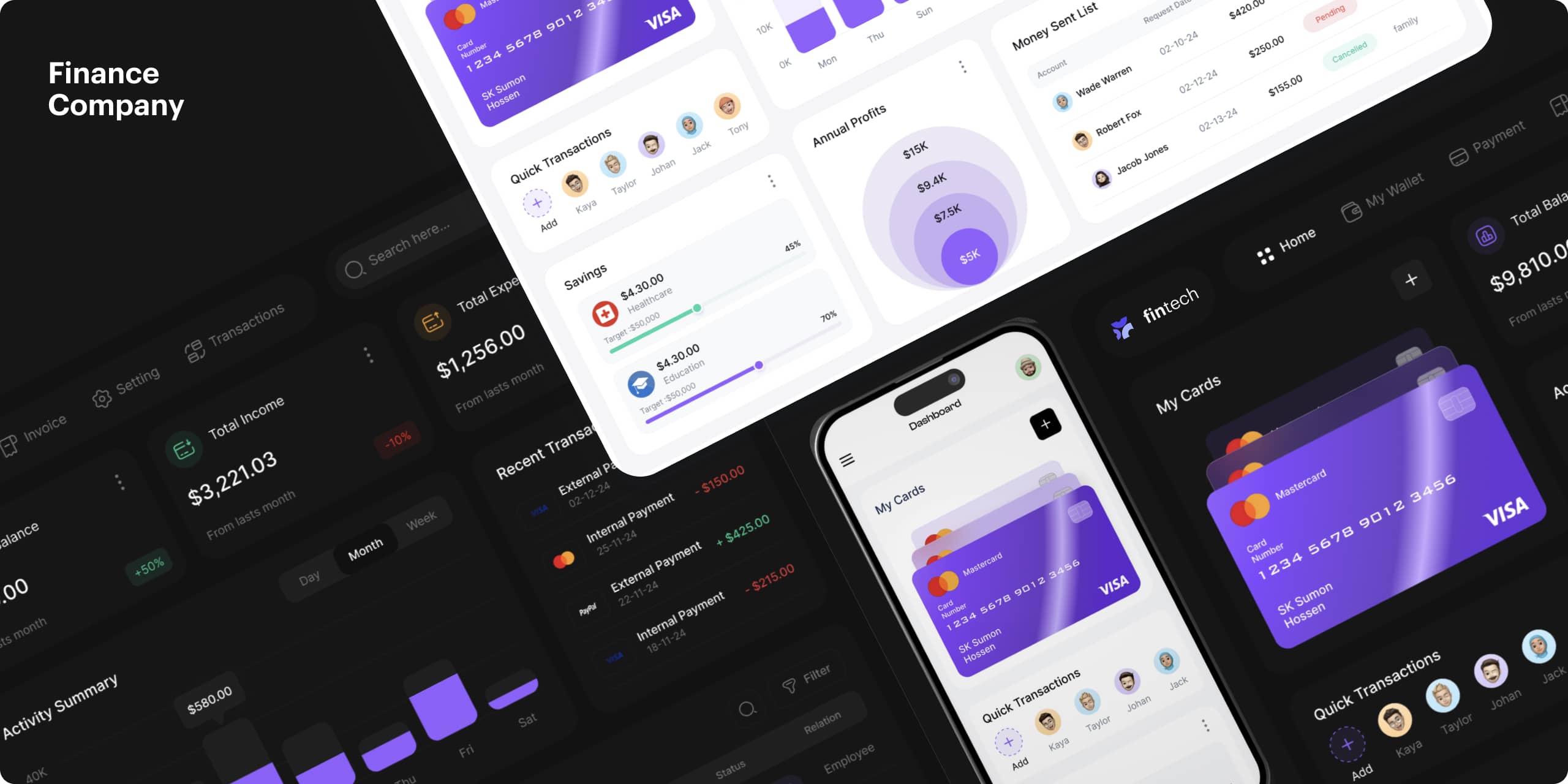

Transforming Financial Services with Innovative Solutions

At the forefront of financial technology, we have partnered with leading financial institutions to deliver cutting-edge solutions that drive growth and efficiency. Here are some examples of our impactful work:

We assumed responsibility for the entire IT function at a European bank, executing critical projects such as banking software replacement support, BI development, ISO27001 compliance, data protection enhancements, and office network replacement. Successfully managed and supported the replacement of banking software through DevOps, Automated QA, and Interface development. Established a robust BI function by creating a data dictionary, developing management reports, and automating report generation. Orchestrated integrations between the new banking system and key third-party solutions like KYC, Fraud Detection, and SWIFT. Facilitated a rapid ramp-up of the BI team to meet project timelines and deliverables, earning client trust and ensuring continuity and efficiency in operations during the transition to a new banking system and data warehouse.

We developed a mobile app for a peer-to-peer lending platform, leveraging APIs from Astra and Plaid for interbank transfers and account access. The app facilitates secure lending and borrowing among friends and family, focusing on easy setup of loan agreements and repayment tracking. We implemented robust security measures and ensured legal compliance to build user trust and protect personal and financial data. Demonstrated responsiveness and timeliness in addressing challenges associated with new API technologies, ensuring project progress and stability. Managed project scope expansion and budget adjustments effectively, accommodating unforeseen factors and client change requests while maintaining project goals.

Our client, a prominent receivables automation company specializing in payment processing for the insurance industry, operates across Canada and the USA. The company faced numerous challenges, including technical debt, the need for new features, scalability issues, inefficient development and testing processes, and inadequate documentation. To address these challenges, Synergo Group leveraged its expertise to revamp and scale the client’s product. This involved tackling technical debt, introducing new features, and enhancing automation tests to boost reliability and scalability. Key improvements included optimizing development and operational processes, establishing robust code review practices, expanding the development team to accelerate feature delivery, and conducting load testing to prepare the platform for increased usage. Additionally, comprehensive documentation was created to improve understanding and onboarding. Through these strategic enhancements, Synergo Group has significantly strengthened the client’s product, ensuring it is prepared for future growth and remains robust and error-free.

Related Other Case Studies

How we proved our software quality and reliability in every project we completed with our clients.

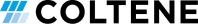

Revolutionizing Dental Device Management

Innovation into Every Fiber – RugSimple

Transforming Finance through Collaboration with Accounting and Audit Software Solutions Provider

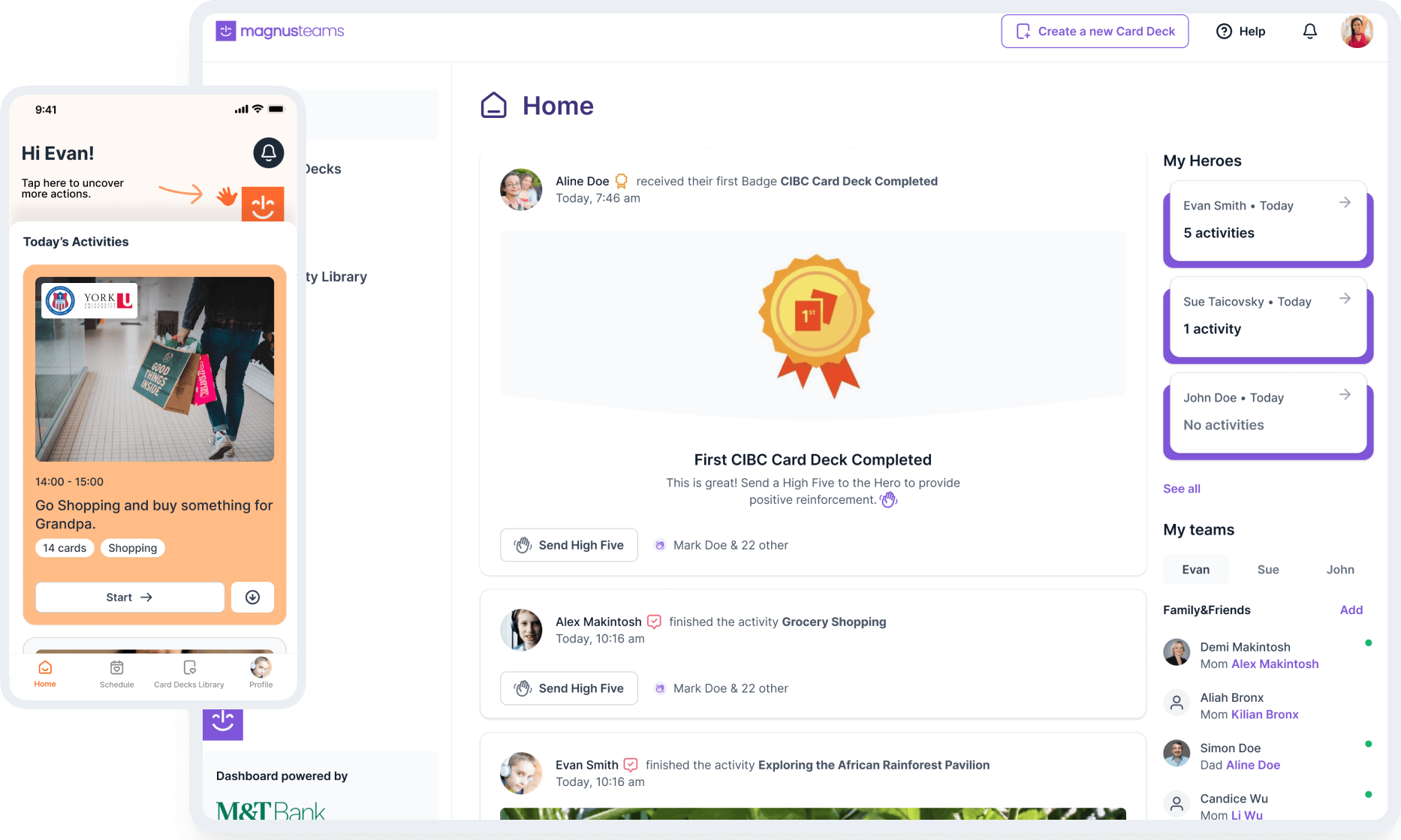

Creating an Accessible World for people with disabilities

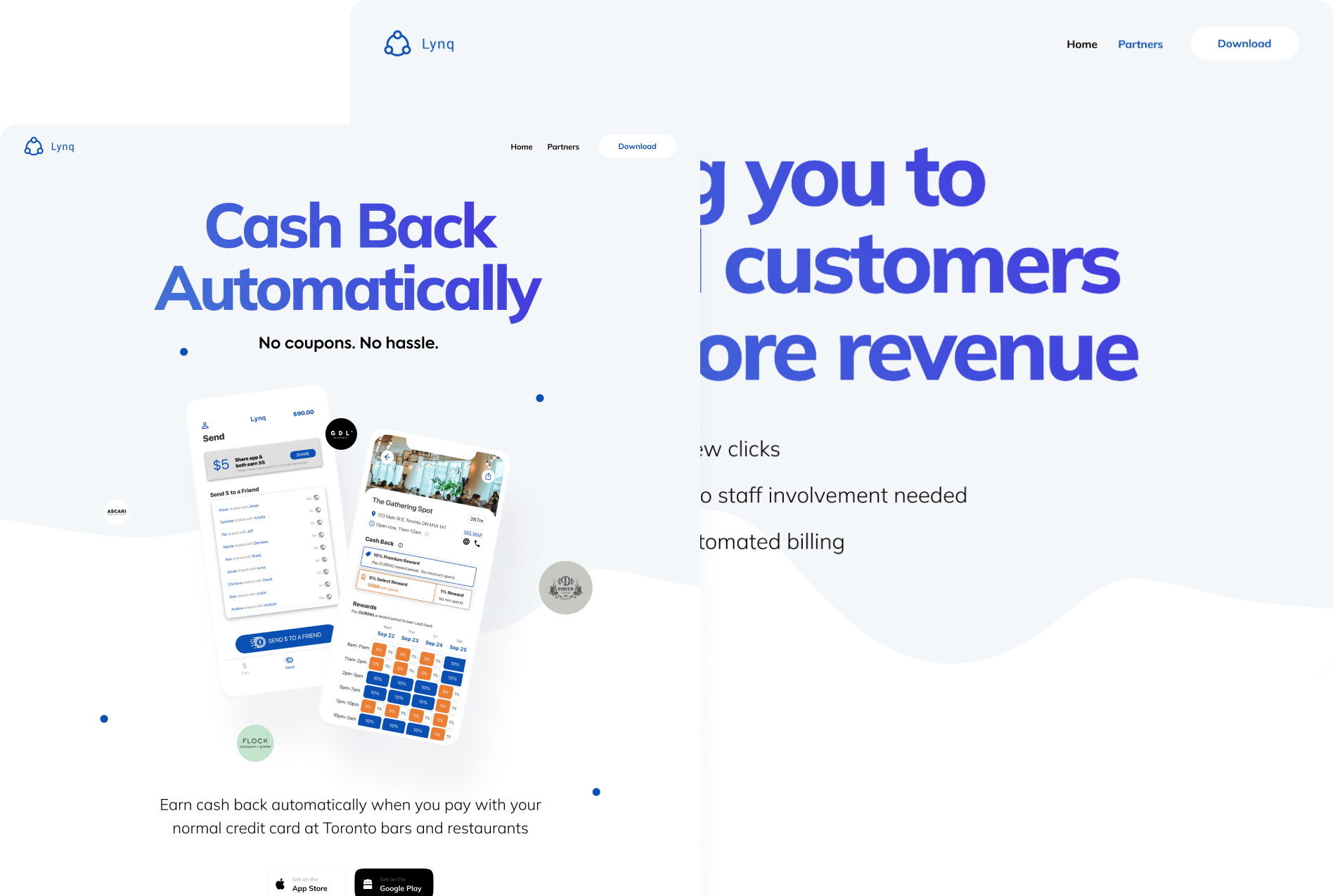

A Mobile App That Creates An Innovative Hospitality Experience – Lynq

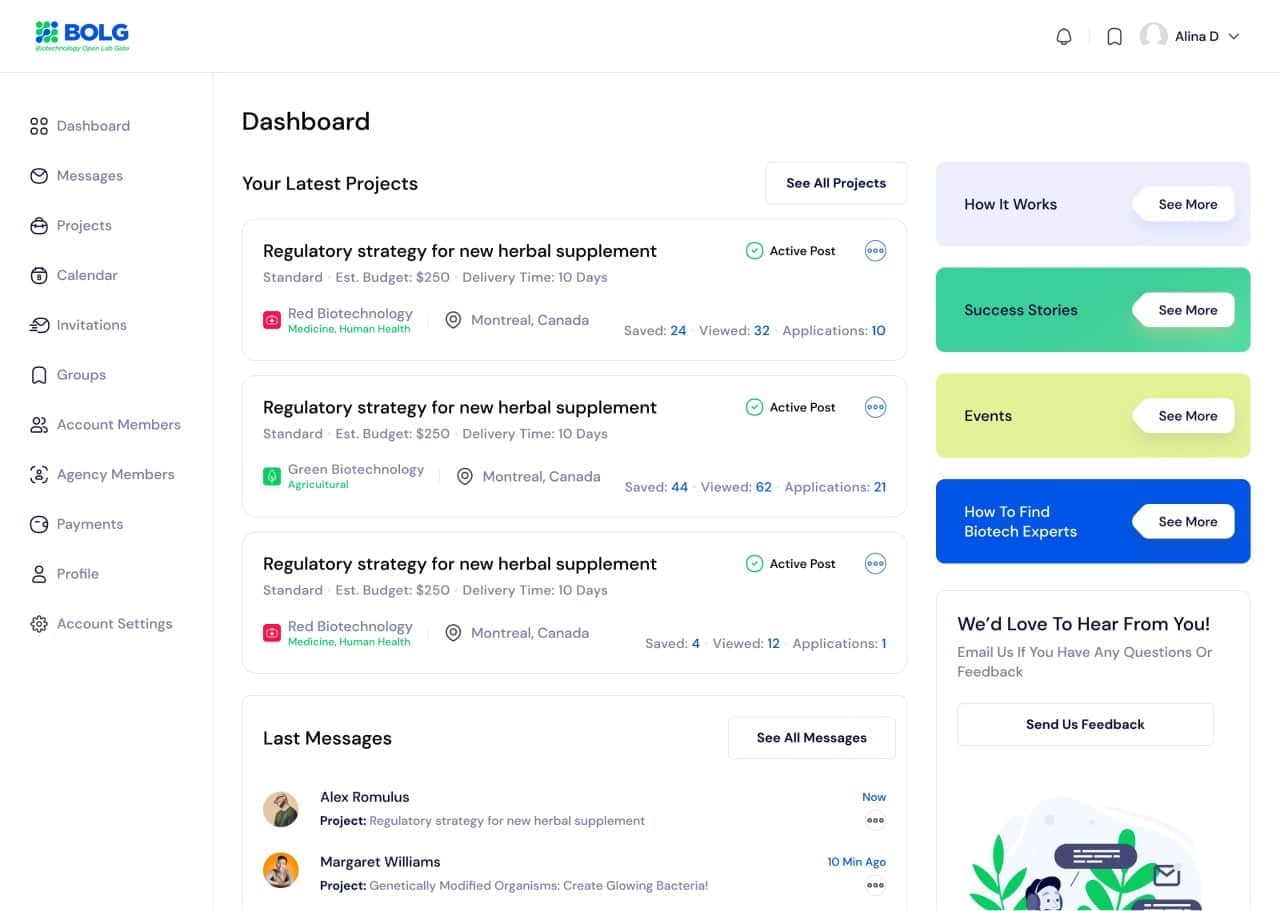

Revolutionizing the Freelance Biotechnology Industry

Revolutionizing Corporate Credit Assessment

Cloud Infrastructure Transformation

Contact us

Let’s synergize and make your project happen

Let’s talk about what we can make, build and scale together.